How Digital Behaviors Can Measure Sports Sponsorship Spend

Advertisers eager to capture consumers’ attention in 2020 are investing heavily in sports sponsorships. The total dollars spent on sports sponsorship is expected to grow 5% in 2020 to $48.4 billion globally, according to a recent analysis by WARC. It is the strongest year over year growth in a decade and is driven by the upcoming 2020 Olympics in Tokyo. North American spending is projected to hit $18.8 billion, with the United States capturing 82.5% of the total figure. However, despite the growth, WARC found that “one in four practitioners has no confidence at all in measuring business return from sponsorships – up from one in five in 2018”.

Putting it succinctly, brands are spending more money than ever on sports sponsorships while acknowledging they have no trusted method to track their enormous investments. This presents a unique opening to apply the latest techniques in machine learning and AI to simplify what is an increasingly complex problem.

One potential solution is measuring fan behaviors for an individual sports property to see if fans’ digital interactions are aligning with sponsors’ activations and messaging. Dstillery used this exact approach by identifying fans of US Soccer and examining the changes in their digital behavior over a 22 month window encompassing the 2018 and 2019 World Cups. An analysis of the results reveals noticeable changes in US Soccer Fan’s behavioral composition from 2018 to 2019.

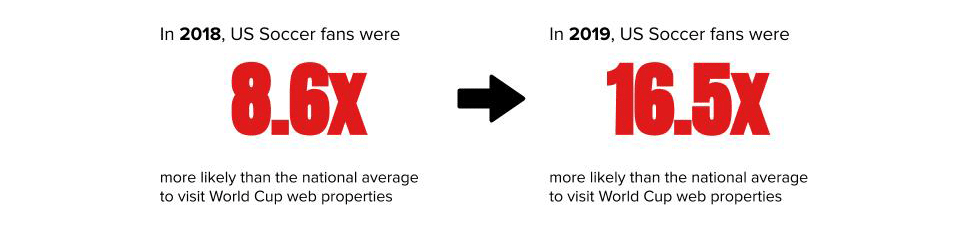

Overall, there was an increased attention to the World Cup in 2019 across the nation. Nielsen reported viewership of the Fox’s broadcast was up 22% from the men’s final last year. However, the interest in the World Cup grew even greater within the niche group of US soccer fans. In one year, US soccer fans’ interest in the World Cup doubled, compared to the national average. Likely driven by the success of the US Women’s National Team in France, the increase is a clear indicator of the digital attention the women’s team’s participation brought to the event. It’s also a reminder for brands that major events draw increased attention from target markets. The 2019 World Cup was an opportunity for sponsors to ride the wave of digital engagement organically generated by the conversations surrounding the women’s team.

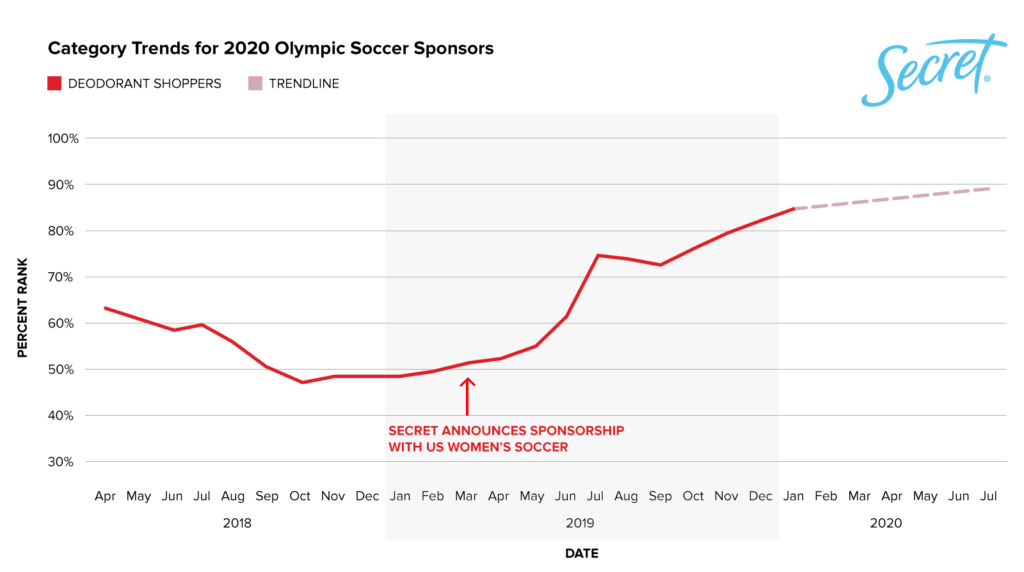

The sponsor who best capitalized on the wave was Secret, a deodorant brand from P&G. Last March, in the lead up to the 2019 World Cup, Secret launched a partnership with the US Women’s National Team. The timing of the announcement aligned perfectly with the increased digital consumption the US women’s team was attracting and propelled digital engagement with the brand’s category. As highlighted above, the US Soccer audience increased their engagement with deodorant shopping, including a massive jump at the start of the World Cup. However, Secret didn’t rely on the momentum of the World Cup to carry their partnership. The brand took it a step further and announced additional financial support amid the USWNT’s push for equal pay. These actions have seen Secret’s alignment with the women’s team become even stronger as deodorant shoppers continue to rank highly for US Soccer Fans.

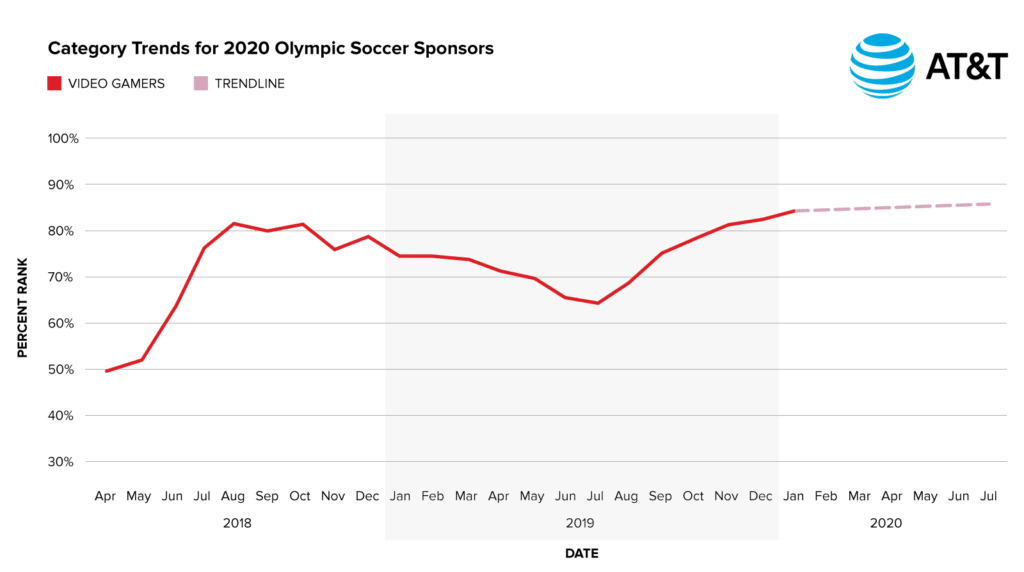

The deodorant brand is not alone. AT&T is another sponsor seeing success in its partnership. As the company rolls out its 5G offering, it has marketed heavily toward video gamers and esports fans. Fortunately for AT&T, US Soccer fans are increasingly interested in video games, which presents a unique opportunity. If the audience’s interest in video games continues, we’re likely to see Video Gamers get closer to the 90th percentile ranking of US Soccer Fans’ behaviors in 2020. The increased percentile ranking would indicate a high affinity of US Soccer Fans for video gaming (i.e. more people engaging with digital gaming content). This is great news for AT&T as it continues its rollout of 5G while maintaining a presence in esports.

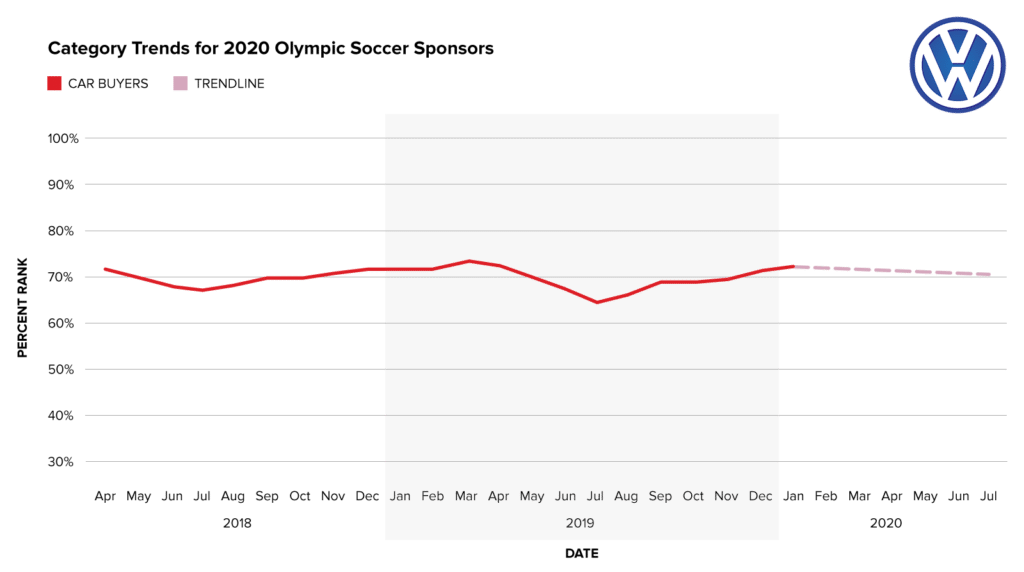

Meanwhile, car buying has remained a consistent behavior of soccer fans over the previous two years, providing steady value for sponsors like Volkswagen. Soccer fans have a strong affinity for buying a car but there are other behaviors that are more consistently characteristic of soccer fans. This could be explained by the lower frequency at which the audience is in-market for a car compared to say, daily or weekly purchases of groceries or video games. Car manufacturers can make an investment, starting with the Tokyo Olympics, in order to stand out to the next generation of car buyers by aligning the brand with a larger purpose. Prophet found that Gen Z, those individuals born between 1997 and 2012, is more committed to “changing the world than their millennial older brothers and sisters” and “expect companies to help, if not take the lead.”

Beyond measuring the success of the dollars they’ve already invested, these brands can use these same trends to predict if their future investments will pay off. Our research suggested a correlation between changes in behavioral composition and sponsorship success. We believe Secret will increase its sponsorship investment with the women’s team and continue to align its brand with the success of the team in Tokyo. AT&T sponsorship investments in soccer, esports, and 5G will present a unique crossover opportunity over the summer and we see AT&T taking advantage. Lastly, Volkswagen faces a challenge to stand out in a crowded automotive category. If the brand can align its messaging with a cause, similar to Secret, it will experience a similar jump in digital engagement and maximize the return on investment.

Going into the Tokyo Olympics, all three trends appear to be in unique positions to capitalize on the projected attention soccer fans will continue to have on the Olympic games. With the USWNT primed to be among the stars of Olympic coverage this summer, these sponsors can expect continued return for their investments.